The IAFF Financial Corporation (IAFF-FC) made an historic change during its February Board meeting, amending its bylaws to allow expanding the Board of Directors to up to 15 members, eight of whom are independent directors.

Independent Directors. A majority of the Board of Directors shall be independent directors – individuals who are not a director, officer or full-time employee of the IAFF, are in good standing within their local and do not have professional conflicts of interest with the business of the IAFF-FC.

In addition to these 11 appointed directors, the Board of Directors is rounded out by IAFF-FC Chief Executive Officer Edward A. Kelly, Chief Financial Officer Frank V. Líma and Chief Operating Officer Kurt M. Becker.

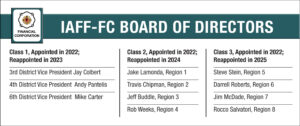

The new Board makeup is as follows:

- Eight independent directors, one from Districts 1 or 3 (Region One); one from Districts 2, 5, 7 or 9 (Region Two); one from Districts 4 or 16 (Region Three); one from Districts 6, 13 or 15 (Region Four); one from District 8 (Region Five); one from District 10 (Region Six); one from Districts 11 or 14 (Region Seven); and one from District 12 (Region 8)

- Up to four IAFF District Vice Presidents

- Three executive officers of the IAFF Financial Corporation

Additionally, the Board of Directors made several important decisions regarding wealth management services for IAFF members.

U.S. Wealth Management Financial Advisory Program

The IAFF-FC approved a strategic partnership between Baystate Financial/Mass Mutual and Galloway Asset Management to provide fiduciary, institutional caliber wealth management and financial planning services to all U.S. IAFF members and retirees. This partnership will give IAFF members access to cutting-edge technology, as well as fiduciary advice from a cadre of the best financial planners in the country – a key component of the IAFF Wealth Management Initiative.

Model Portfolio Solutions Builders

The IAFF-FC approved a strategic partnership with Natixis Investment Managers and Franklin Templeton, which are among the largest and most successful money managers in the world to establish model portfolios. Many of the world’s wealthiest individuals and institutions have for years used professionally managed model portfolios rather than traditional, retail mutual funds that typically carry much higher costs and less robust returns than their model portfolio counterparts. This partnership will give IAFF members access to the investment tools that would have otherwise been beyond the reach of all but the wealthiest of our personnel.

Canadian Wealth Management Financial Advisory Program

The IAFF-FC will be launching a Request for Proposal (RFP) at the end of February to the largest Canadian banks and Canadian insurance companies seeking partners for our Canadian members and retirees to provide wealth management, financial planning, investments, insurance products and banking products in a comprehensive manner similar to the services available in the United States.