The U.S. House of Representatives has passed HR 5377, the Restoring Tax Fairness for States and Localities Act, legislation that restores the state and local tax (SALT) deduction by removing the $10,000 cap for a period of two years.

The current cap was a result of a larger tax package that was passed in 2017. This bill is a step in the right direction towards fully restoring the SALT deduction for all hard-working public safety workers. Originally introduced by Representative Thomas Souzzi (D-NY), the bill passed by a vote of 218-206.

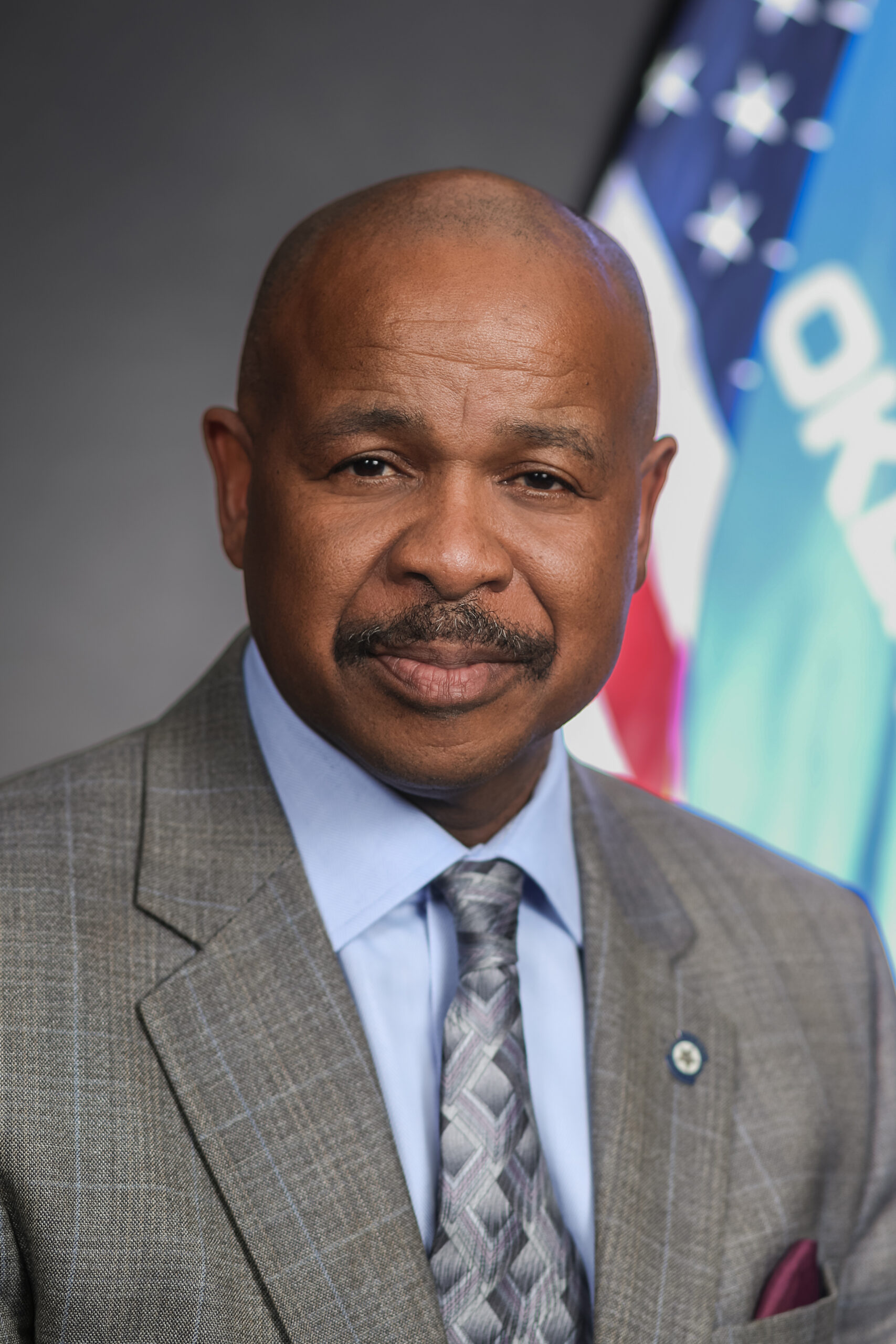

“This important legislation provides real relief for public safety workers and the communities they protect,” says General President Harold Schaitberger. “Removing the cap on SALT deductions allows municipalities to make decisions on funding fire departments based on needs, not politics.”

In 2017, Congress passed the Tax Cuts and Jobs Act. As a result, SALT deductions for taxpayers were capped at $10,000 annually. Previously, a tax filer could deduct a combination of state and local income, sales and property taxes. Due to this arbitrary cap, localities providing essential public safety services faced the very real threat of increased taxes, shrinking budgets and service cuts. Justifying their actions, opponents argued that it was the very wealthy who took advantage of this deduction. But analysis shows that as much as 86 percent of taxpayers earning under $200,000 a year claimed the deduction in 2016. This is a benefit that impacts all workers in every state across the country.

In addition to reforming the SALT deduction, HR 5377 creates a $1,000 above-the-line tax deduction to benefit professional fire fighters who pay for uniforms, training and certifications out of pocket. The SALT reform, coupled with the new $1,000 deduction, provides real relief for fire fighters and the communities they serve to protect.

The IAFF identified the SALT deduction issue as a top priority during the 2017 tax reform debate and fought aggressively against its full repeal. When Congress compromised on a $10,000 cap, it was seen as a small but temporary victory. This union has never wavered on its commitment to fully reinstate the cap and with today’s vote, that objective has moved one step closer towards the finish line.